In March, the U.S. House of Representatives extremely passed a costs that might require ByteDance to divest TikTok or deal with a restriction in U.S. app shops. Much of the associated conversation and dispute has actually focused around American information security and speech rights, however a prospective relocation likewise highlights something else: TikTok is growing its concentrate on e-commerce, however the interaction of tech giants and geopolitics is squeezing smaller sized merchants.

Over the previous couple of months, merchants– much of them from China– searching for an Amazon option have actually gathered to TikTok to pitch clothing, cosmetics, electronic devices and a range of other items to U.S. purchasers, by method of TikTok Shop. In interviews with TechCrunch, sellers from Shenzhen– the Chinese megacity that’s a significant center for Amazon merchants– stated they felt a cumulative sense of disappointment over increasing geopolitical stress and “vulnerability” about a prospective TikTok restriction.

“The scenario is not within our control,” a seller concentrating on maternity and child items informed TechCrunch. “It’s simply hard to understand how things will establish.” With existing supply chains difficult to move, “we simply need to play it by ear.” (The sellers asked not to be called due to political level of sensitivities.)

TikTok Shop formally released in September 2023 with 200,000 merchants currently on board. Because then it has actually not offered any upgraded numbers on how numerous merchants are presently on the platform, nor how much they offer there, nor how numerous offer somewhere else (and where else that may be).

Research Study from Jungle Scout, an Amazon information intelligence company, offers some concept of TikTok’s e-commerce effect. It discovered that 20% of Amazon sellers, brand names, and companies have strategies to broaden to TikTok Shop this year. Before the present political reaction removed, ByteDance supposedly forecasted that it had the possible to grow its U.S. e-commerce company significantly to $17.5 billion this year.

TikTok isn’t the only platform on the list for merchants trying to find more channels beyond Amazon to broaden their consumer bases. Its increase becomes part of a larger shift we’ve been seeing around alternative markets like Temu commanding more attention not simply from consumers, however likewise from Chinese e-commerce exporters and merchants. And Amazon is supposedly taking notification, another indication that options are getting traction.

TikTok did not right away respond to an ask for remark.

A brand-new method to offer and purchase

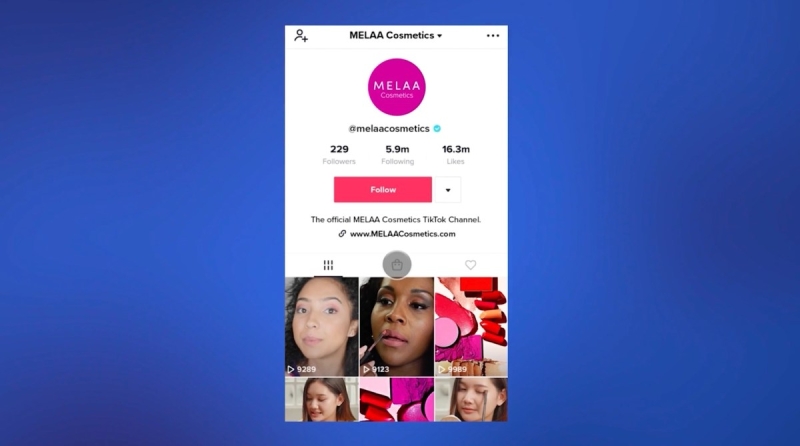

TikTok has actually been attempting to improve its e-commerce service considering that the U.S. launch last September.

The app is popular– or notorious, depending upon who you talk with– for how it securely manages what material is appeared for whom. TikTok Shop likewise has a strong dosage of curation to it.

Unlike Temu, understood for its seas of inexpensive, white-labeled items from Chinese factories offered straight to U.S. customers, TikTok’s technique has actually been to onboard and highlight more top quality products, making it more of a direct rival to Amazon.